work in process inventory

Classify each product cost as either direct materials direct labor or factory overhead. Classify each cost as either a product or period cost.

Solved Beginning Finished Goods Inventory Beginning Work In Process Inventory Beginning Raw Materials Inventory Rental Cost On Factory Equipment Direct Labor Ending Finished Goods Inventory Ending Work In Process Inventory

Process Inventory Work.

. Work-in-process inventory is materials that have been partially completed through the production process. The costs included in the work-in-process inventory account are direct. Work in process inventory includes all raw goods production expenses and labor costs associated with producing merchandise inventory.

Work-in-process WIP inventory pertains to the goods for which the manufacturing has begun but not yet completed. The WIP inventory and supply chain. Work-in-process inventory is the inventory account used to track the manufacturing costs of unfinished products.

Work in process WIP inventory refers to goods that are in process but not yet completed. The value of that partially completed inventory is sometimes also called. Raw materials as well as the.

Classify each period cost as either. In other words WIP is the items on the factory floor. What Is Work-In-Process Inventory.

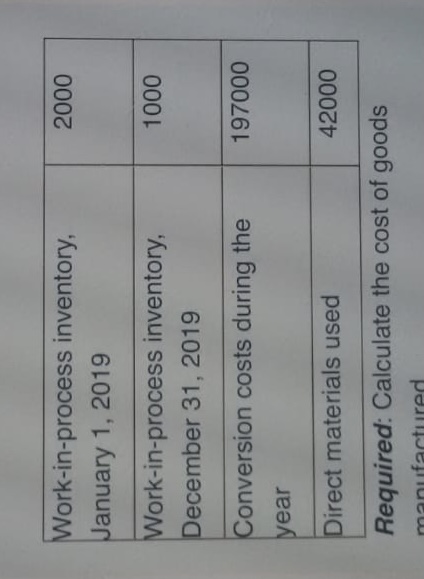

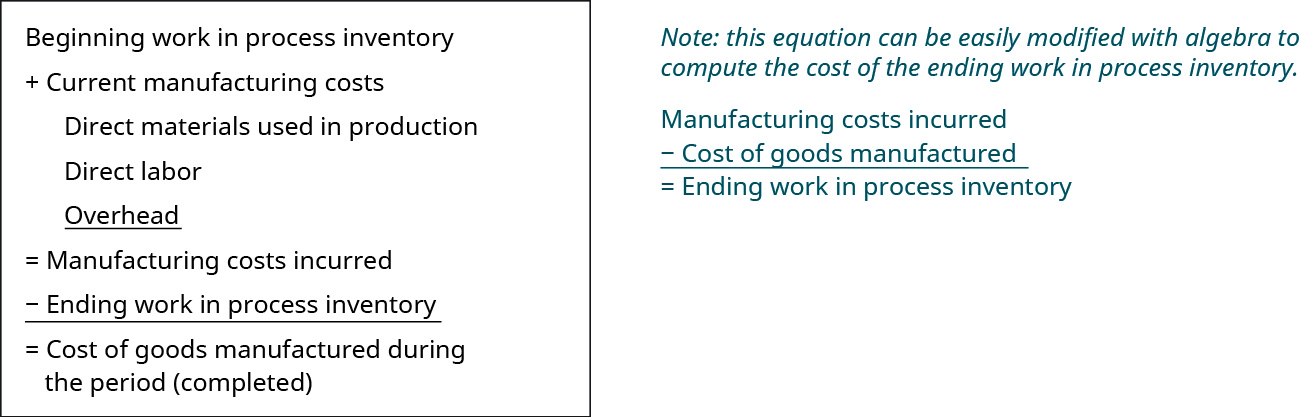

Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs- Ending WIP. Work in process WIP is inventory that has been partially completed but which requires additional processing before it can be classified as finished goods inventory. A work-in-process inventory account is a virtue account used to trace the cost of partially finished goods.

Adding the totals of these categories. Define Work in Process Inventory WIP The work in process inventory refers to materials related to products that require additional production at your packing and shipping. For supply chain management WIP inventory includes all costs associated with.

Work-in-process WIP refers to a component of a companys inventory that is partially completed. WIP is a term referring to the partly finished materials included in any round of production. As raw materials and components are.

This account includes manufacturing costs such as labor cost partial and raw material. A work in process or WIP for short is the term that refers to any inventory thats been initiated into production but hasnt been completed by the end of a companys accounting. WIP or Work in Progress is a part of a companys overall inventory that has begun being processed but is not yet finished.

These items are typically located in the production area though they. To calculate your in-process inventory the following WIP inventory formula is followed. A work in process inventory describes a piece of finished material that has yet to be completed in a manufacturing process.

Work in Process Inventory includes the cost of the direct materials in production at that particular time direct labor costs and the portion of manufacturing overhead allocated.

Work In Process Inventory Definition Calculation And Example Efex Podcasts On Audible Audible Com

Learn About Work In Process Inventory Chegg Com

What You Need To Know About Work In Process Inventory Locad

How A Job Costing System Works

Work In Progress Wip What Is It

Simulation Results For Work In Process Inventory Wip For Manufacturer A Download Scientific Diagram

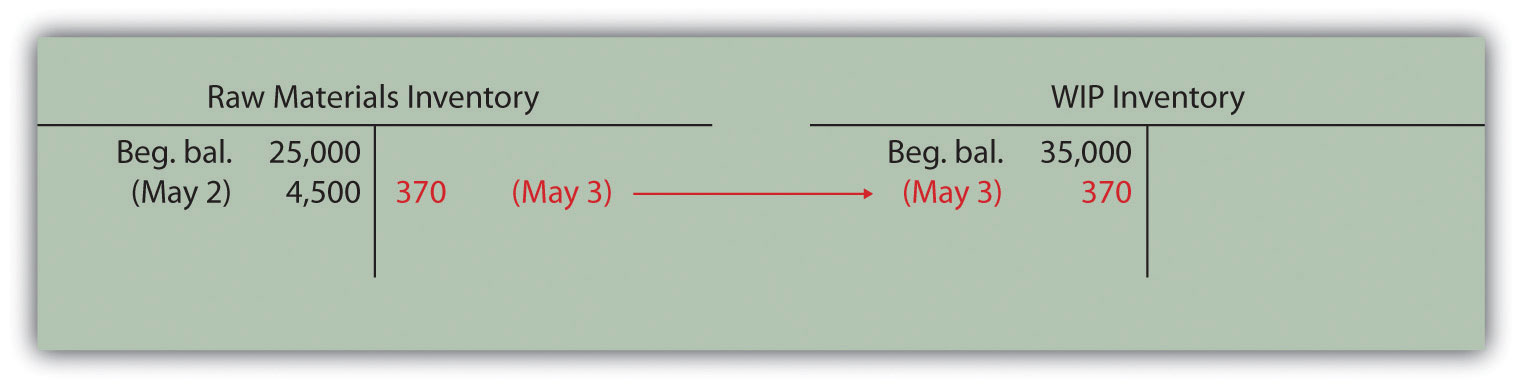

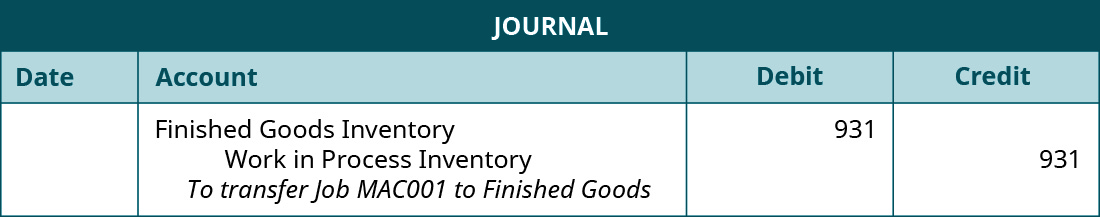

Tracking Job Costs Within The Corporate Ledger Principlesofaccounting Com

Solved Problem 1 Problem 2 Problem 3 Problem 4 Thank You Course Hero

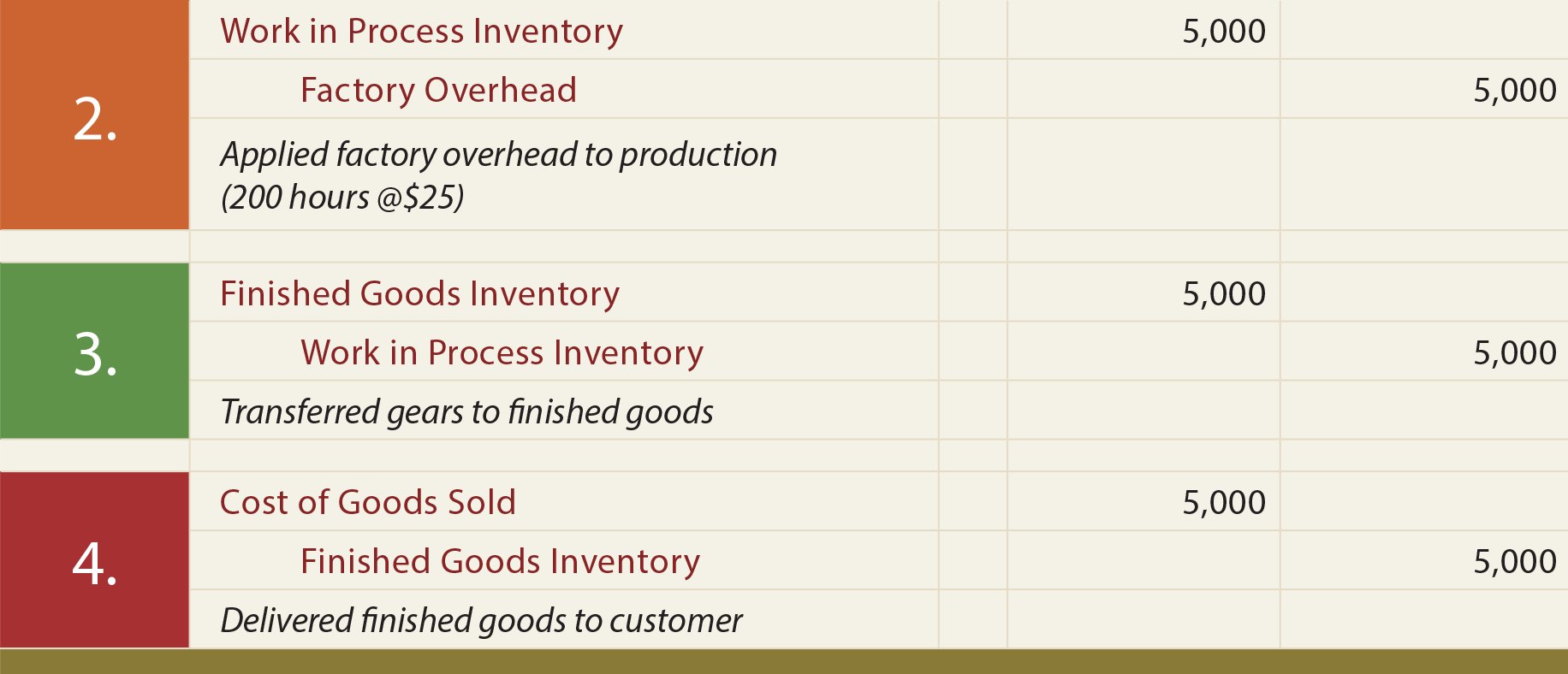

8 4 Tracing The Flow Of Costs In Job Order Financial And Managerial Accounting

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

8 4 Tracing The Flow Of Costs In Job Order Financial And Managerial Accounting

Work In Progress Wip Definition Example Finance Strategists

What Is Work In Process Inventory Ecommerce Inventory Costs

How To Calculate Manufacturing Work In Progress Wip Solutionbuggy

How To Calculate The Ending Work In Process Inventory

Compute The Cost Of A Job Using Job Order Costing

1 4 Quiz 1 Part 2 Final Manufacturing Problems Pdf Cost Of Goods Sold Financial Accounting