palm beach county business tax receipt appointment

Commercial locations must submit the following. Business Tax Receipt Select this type of service if you need to apply for a new local business tax or renew your local business tax.

Residential Business Tax Receipt Affidavit City Of Deland

Here is the link for the Application for Business Tax Receipt.

. Gannon is pleased to announce employees of the Palm Beach County Tax Collectors Office raised 2162850 in 2021 to support two local nonprofits. These fees are for the most common type of applications. Monday - Friday 800 am.

Make sure to select Business Tax as your appointment type. You can reach the Palm Beach County Planning and Zoning Office at 561-233-5000 if you need assistance. Tax Collector Office Employees Donate More Than 21000 in 2021.

If you want to open a home business in your town you may be able to do so but make sure you check the license s you need first. Box 3715 West Palm Beach FL 33402-3715. Royal Palm Beach FL 33411.

A team member will. The Zoning Public Information Planner will review the request and verify the zoning district and whether the use is allowed for that specific location. Please submit your business tax application or rental license application via email to.

West Palm Beach Fla. 561 227 - 6411. The most common fee is 33 and is charged to businesses with 10 or fewer employees.

Clients moving to Palm Beach County who are establishing residency are considered Palm Beach County residents. Palm Beach County Tax Collector Attn. However if the lobby has more than 10 people in it you may have to wait in courtyard until the lobby space becomes available.

Applying For a Palm Beach County Local Business Tax Receipt. Palm Beach County Tax Collector Attn. Economic Council of PBC.

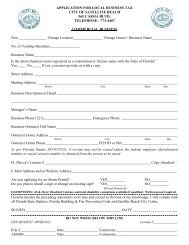

APPLICATION FOR PALM BEACH LOCAL BUSINESS TAX RECEIPT. Living Hungry and Making Every Day Count. Palm beach county business licenses Show more.

360 South County Road. Box 3715 West Palm Beach FL 33402-37152. The address on your local business tax receipt must match the physical address you are registering with our ofifce.

Complete the Application for Local Business Tax Receipt. Business Tax Department PO. For specific businesses or if you are unsure please call 561-799-4216 for fee estimates.

Business Tax Receipt for Short Term Rentals are only processed at our administrative office on the third floor of the Governmental Center 301 N. Make an appointment at one of our service centers to process your completed application. Please note that any business that opens or begins operating prior to obtaining an approved business tax receipt will be charged an additional penalty of 2500.

APPLICATION REQUIREMENT GUIDE CHECKLIST Please complete application on reverse side. At the Customer Service counter located on the 2nd floor of the City Hall Annex 120. Service is provided Monday through Friday from 830 am.

Requirements for making an appointment. Mail completed application to. Business Tax Department PO.

Palm Beach FL 33480. Click Here to Schedule. Completed Village of North Palm Beach Business Tax Receipt Application Be sure to answer all of the questions completely including the narrative and notarize the signature Completed Palm Beach County Business Tax Receipt Application Do not go to the County Tax Collectors Office until.

Dont wait until the last minute. A copy stays with the Village. Business Tax Department PO.

Complete the Application for Local Business Tax Receipt. Complete the Business Tax Receipt form which can be obtained at the Tax Collectors Office or in the Zoning Division lobby located the second floor at 2300 North Jog Road West Palm Beach FL. Palm Beach County Tax Collector Attn.

County Line Ad Contract and Deadlines. CED Department is responsible for the issuance and collection of all Business Tax Receipts under the authority of Chapter 110 of the City of Palm Bay Code of Ordinance. Return the original form to the Tax Collectors Office to obtain a Business Tax Receipt for Palm Beach County.

2 a valid palm beach county local business tax receipt previously called occupational license 3 an original certificate of insurance evidencing general liability coverage in the amount of 50000000 minimum. The Palm Beach County Occupational License Office is located at 561-355-2272. Palm Beach County Tax Collector Attn.

BUSINESS TAX APPLICATIONCERTIFICATE OF USE. Palm Beach County Office of Equal Business Opportunity OEBO 50 South Military Trail Suite 202 West Palm Beach FL 33415 PH. Box 3353 West Palm Beach FL 33402-3353.

Walk in appointments are available if lobby space permits. 401 Clematis Street West Palm Beach Florida 33401. Failure to have a current palm beach county local business tax receipt will result in the disapproval of your license application until such time that a palm beach county local business tax receipt is obtained.

Constitutional Tax Collector Anne M. All companies One-person and home based companies included in Palm Beach County selling merchandise or services are required to purchase a Business Tax Receipt. Schedule your appointment today.

Box 3353 West Palm Beach FL 33402-3353. Call our Tourist Development. Make an appointment at one of our service centers to process your completed.

You may contact the office at 5616166840 to. Business Tax Department PO. Constitutional Tax Collector Serving Palm Beach County PO.

Mail completed application to. Complete the top portion of the Application For a Palm Beach County Local Business Tax Receipt and receive sign off by the Royal Palm Beach Planning and Zoning Department. Schedule your driver license appointment up to 60 days in advance.

Complete the Business Tax Receipt form which can be obtained at the Tax Collectors Office or in the Zoning Division lobby located the second floor at 2300 North Jog Road West Palm Beach FL. FOR OFFICE USE ONLY. West Palm Beach Florida Mon.

THIS APPLICATION IS NOT A BUSINESS TAX RECEIPT OR CERTIFICATE OF USE.

Business Tax Receipt How To Obtain One In 2022 The Blueprint

Fill Free Fillable Constitutional Tax Collector Pdf Forms

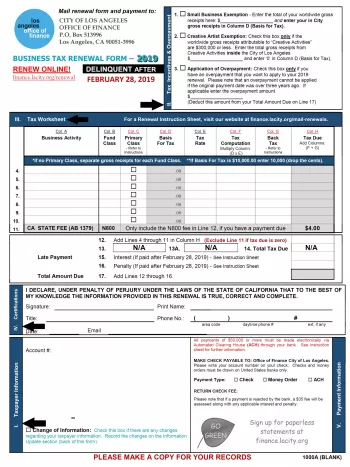

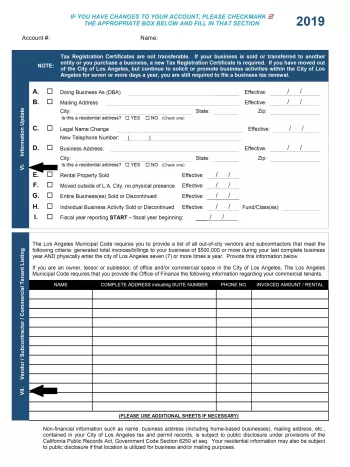

Business Tax Renewal Instructions Los Angeles Office Of Finance

Business Tax Receipt How To Obtain One In 2022 The Blueprint

Business Tax Renewal Instructions Los Angeles Office Of Finance

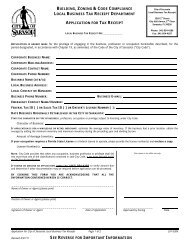

Residential Business Tax Receipt Affidavit City Of Deland

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Fill Free Fillable Constitutional Tax Collector Pdf Forms

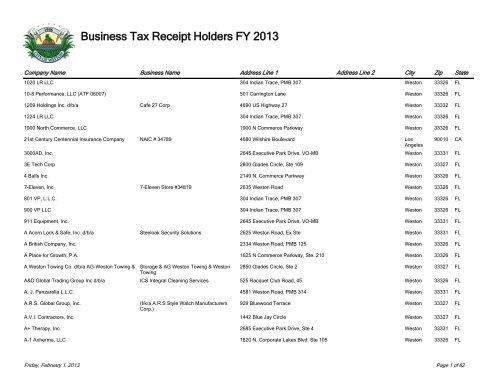

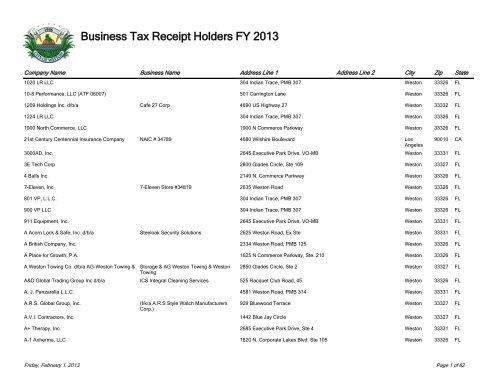

Business Tax Receipt Holders Fy 2013 City Of Weston

Residential Business Tax Receipt Affidavit City Of Deland

Business Tax Receipt How To Obtain One In 2022 The Blueprint